The Responsible Investor Digital Festival was an online event lasting from June 15th to 19th 2020. It was filled with in-depth discussions about responsible investing. To save your time, we have summarized some key insights from a discussion about the challenges and current progress in reaching a global economy with net-zero emissions, titled “The road to net-zero economies and the investment implications”.

The discussion had five speakers: Remy Briand (MSCI), Jaspreet Duhra (S&P Dow Jones Indices), Luis Cabra (Repsol), Adam Matthews from (the Church of England Pensions Board) and Will Martindale (PRI).

They talked about how the mindset of responsible investment has gradually changed over time.

- Initially it was understood from a financial risk and opportunity lens.

- Now it’s more about managing outcomes.

- That means, when earlier the goal for responsible investors was to protect their assets from the risks of climate change, now the goal is becoming more about how to achieve concrete outcomes in the world, for example achieving net-zero emissions.

- This is reflected in the EU Taxonomy and the the Task Force on Climate-related Financial Disclosures (TCFD), which is an initative by the Financial Stability Board (FSB) that reports about climate related financial risk. Both are created through this new lens of outcome oriented impact investment.

The representative of Repsol talked about the nuances of being a net-zero company.

- Being net-zero is easy to understand in principle, but difficult in practice.

- In principle it means that you are a company that has zero impact on the atmosphere in total. This can be done directly or by compensating your emissions (offsetting).

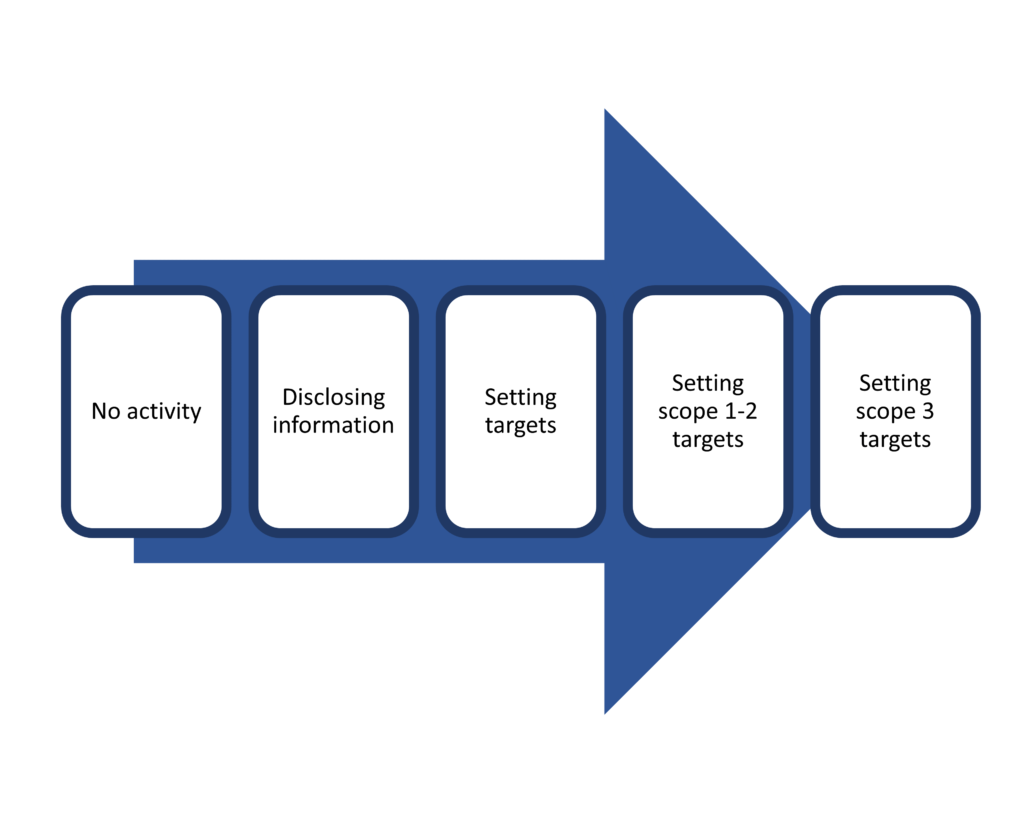

- In practice, it has many nuances. The most important one, which was mentioned multiple times throughout the plenary, is the difference between Scopes 1, 2 and 3.

- Scope 1 covers all direct emissions by the company, for example by driving company cars.

- Scope 2 covers indirect emissions that come from using electricity.

- Scope 3 covers all indirect emissions, including emissions produced by the use of products, rather than just production. This often makes up the majority of emissions.

- Very few companies actually include Scope 3 in their targets and measurements.

Luis Cabra also shared Repsol’s approach to offsetting.

- Their first priority is decarbonizing their own production.

- However, if it is not possible to meet the targets in time, they will resort to offsetting.

- In addition, they give their customers the option to offset their emissions that come from using Repsol products and services. Half the price of offsetting is paid by the customer, the other half is by Repsol.

- In conclusion, offsetting is used, but not as a substitute for the main goal of reducing emissions.

There are three leves where investors can manage their outcomes.

- By aligning their portfolio.

- By engaging companies.

- For example, by urging companies to set goals to reduce emissions

- or to join initiatives, such as Climate Action 100+ to help companies meet their emissions goals.

- By engaging policy makers.

The aspect of engaging policy makers is often overlooked or done poorly. The speakers gave their thoughts on how to do it better.

- The main point brought out was the need for a detailed stakeholder mapping.

- In order to drive policy change, you first need to understand how decisions are made. Who is in power to drive the changes you want to make.

- It is also important to understand in detail how the economy should change to meet the sustainability goals.