Would you like to save a few hours? We have mapped out the similarities and differences of the new Impact Analysis Tools for corporations and banks by the United Nations Environment Programme Finance Initiative (UNEP FI). These tools assist banks, investors and socially responsible companies with planning, managing and improving their impact on society and the environment.

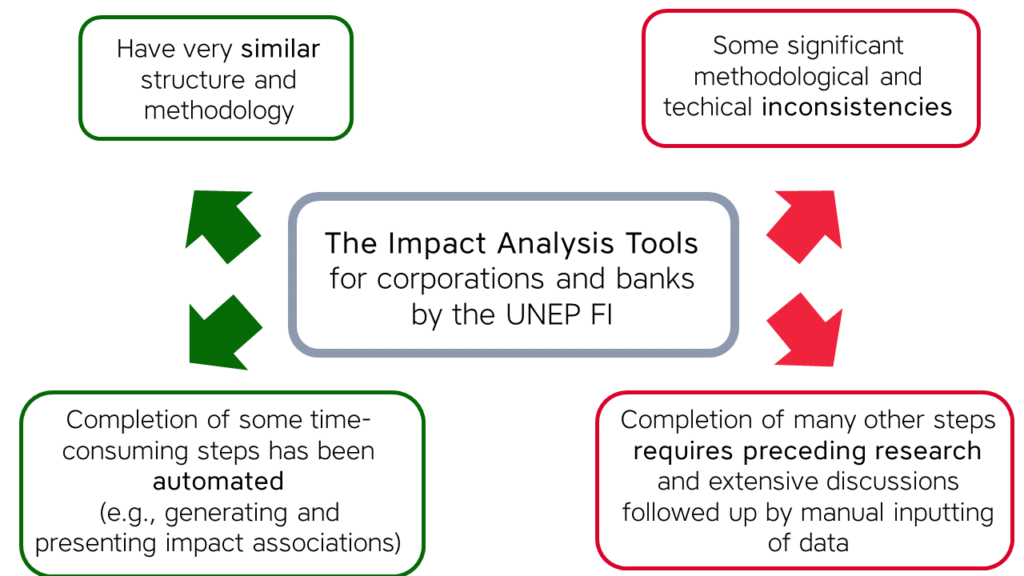

One of these tools helps assess banks´ and investors´ client and investee companies individually (the Corporate Tool), another to analyse banks´ portfolios in their entirety (the Portfolio Tool). We have created manuals for both of them: the manual of the Corporate Tool, and the Manual of the Portfolio Tool. The following figure displays the main strengths and weaknesses of the tools.

Similarities and differences

While the tools do have a similar structure and methodology, there are a number of differences . The main similarities and differences for each section of both tools are presented in the following table.

Table 1. Comparison of the Corporate and the Portfolio tools

| Corporate Tool | Portfolio Tool |

| Main differences 1. Suitable for a for-profit company (especially large multinational corporations) 2. Includes information about impact management capabilities 3. Summarized by giving the company a single rating |

Main differences 1. Suitable for a bank 2. Information collection is separated by four different banking types 3. Summarized by presenting an overview of most significant impact areas and the bank’s impact performance in those areas |

| Company cartography • Asks about sectors, countries of operation, company’s influence (i.e. whether it is among the market leaders) • 3 types of countries are separated: countries of sales, production, sourcing – Does not ask about the types of customers |

Bank cartography • Asks about sectors, countries of operation, bank’s influence (i.e. its rank in the league tables) • 4 types of banks are separated: consumer, business, corporate, investment banking + Asks about the types of customers |

| Country impact needs • Asks about the societal needs of each country of operation |

Country impact needs • Asks about the societal needs of each country of operation |

| Corporate impact profiles Each sector separately & then all sectors summarized • Shows impact associations for sectors – Does not show impact associations for customer types • Shows country needs • Highlights the LDCs (i.e. the least developed countries) |

Portfolio impact profiles Each bank type separately & then all bank types summarized • Shows impact associations for sectors + Shows impact associations for customer types • Shows country needs • Highlights the LDCs (i.e. the least developed countries) • Highlights areas of high influence • Highlights key sectors + Option to add open comments – No option to amend values |

| Highlights areas of high influence • Highlights key sectors + Option to amend values – No option to add open comments |

Highlights areas of high influence • Highlights key sectors + Option to add open comments – No option to amend values |

| Most significant impact areas • Asks to list the most significant impact areas based on earlier information • Asks to justify the choices |

Most significant impact areas • Asks to list the most significant impact areas based on earlier information • Asks to justify the choices |

| Impact performance Each sector separately & then all sectors summarized • Asks about quantitative and qualitative impact performance data + Asks about being in line with internal goals • Asks to compare performance with peers • Asks to compare performance with wider policy goals + Asks about predictive models – Does not ask about significant controversies • Asks to assign a performance status |

Impact performance Each banking type separately without any summary • Asks about quantitative and qualitative impact performance data – Doesn’t ask about being in line with internal goals • Asks to compare performance with peers • Asks to compare performance with wider policy goals + Asks about significant controversies – Does not ask about predictive models • Asks to assign a performance status |

| +Asks about impact management capabilities | – No impact management section |

| Conclusions • Asks to choose a final rating for the company from one of three PI (Positive Impact) statuses: PI, PI transition, Not PI |

Priority impact areas • Shows the ranked list of most significant impact areas from earlier steps • Shows the impact performance ratings from earlier |

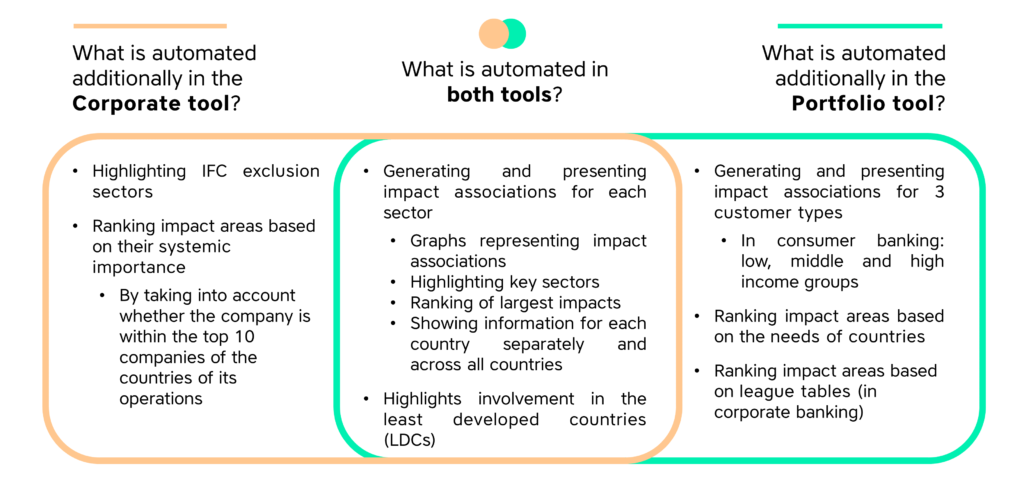

What has been automated in the tools?

One of the key attractions of the tools lies in automating some of the time-consuming elements of mapping the potential positive and negative impacts of banks, investment portfolios and corporations. The following figure shows the main elements that have been automated.

To enable running the algorithms and complete the analysis, the users still need to provide extensive manual inputs. Examples of the activities that have not been automated:

- Gathering the country needs statistics;

- Establishing country needs scores based on the collected data;

- Choosing the most significant impact areas;

- Choosing the indicators to measure your impact;

- Actually measuring your impact in practice;

- Scoring your current impact performance status;

- Scoring your current impact management status;

- Choosing final PI (Positive Impact) status (in the Corporate Tool).

Administratively, the most time-consuming non-automated parts are perhaps gathering the statistics about the country’s needs and choosing the exact indicators to measure your impact.

Also, a number of non-automated steps definitely need a well-argumented and transparent decision-making process inside the user’s organization. These steps include the choices about scores concerning impact performance and management status.

In conclusion: while the automated parts of the tools may save the users lots of time, still much time needs to be invested into validating the automated suggestions from the tools and completing the non-automated sections (including those that need input from relevant stakeholders internally and externally).

If you need any help with your own impact targets and activities, do get in touch with us at info(at)storiesforimpact.com or using our contact form.