The Responsible Investor Digital Festival was an online event lasting from June 15th to 19th 2020. It was filled with in-depth discussions about responsible investing. To save your time, we have summarized some key insights from a discussion about how technology should be used to increase responsible investing, titled “Catalysing ESG and sustainable finance through Fintech and AI”.

The session had 3 speakers: Armen Papazian (Value Xd), Ralf Frank (Ralf Frank International), Michael Zimonyi (CDSB).

Armen Papazian from Value Xd introduced the concept of Space Value of Money, proposing an important shift in thinking about investing.

- For all of history, investors have been taught to be risk averse and think only of value gained for themselves or their firm through investing. All of the textbooks and trading algorithms are in this mindset.

- Armen says that investors need to change and think about how they can manage their outcomes and directly contribute to social and environmental value with their investments. Models, algorithms and textbooks need to reflect that mindset.

- To change that Armen proposes a new metric, the Space Value of Money. Taking that into account, investors would look at the positive value gained with each invested dollar and use that to divert their investments to bring about more positive change.

Armen also stresses the need to integrate sustainable investing into algorithmic trading.

- 70% of trading is algorithmic. To integrate the financial world with sustainable investing, we need quality data points fed directly into algorithms. We also need algorithms and models that take ESG value into account.

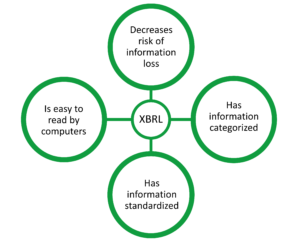

Another speaker was Michael Zimonyi from CDSB and he talked about the value of using digital reporting using XBRL.

- In essence, it is similar to using barcodes on books. It is a systemic and consistent way of storing information that is easy for computers to read. Michael proposed that we should have a similar system on ESG data.

- Using XBRL would mean that:

- information is easy to read by computers;

- information is categorized;

- information is standardized;

- there is less chance of information loss.

- He stressed that using XBRL would not replace human decision making in reporting. It would just be an additional tool in our arsenal.

We have summed up the most important aspects on the following diagram.

Do you have a topic or challenge that you would like us to analyze and visualize? If so, please do get in touch with us via e-mail info(at)storiesforimpact.com or using our contact form.